This post is also available in:

Do you plan to buy an apartment or villa in Turkey? There are a few things you should know before making a final decision. If you have questions about the procedure of buying property in Turkey, please contact our Anga Real Estate team.

Buying an apartment in Turkey: who can buy real estate and how?

According to the law “Legal acquisition by Foreigners of Turkish Real Estate in Turkey” since 2012, citizens of 183 countries can buy real estate in Turkey. Foreign citizens are free to buy property anywhere in Turkey, except for:

● military zones;

● on The Black sea coast;

* it does not allow foreigners to buy plots of over 30 Hectares.

According to statistics, foreigners most often buy real estate in the Mediterranean and Aegean seas, and in Istanbul.

What do I need to know about the legal features before buying a property in Turkey?

We suggest that you consider the main legal possibilities and responsibilities if you become a homeowner in Turkey.

* The purchase of real estate in Turkey is the basis for obtaining a residence permit. Foreigners who buy real estate in Turkey for 250 thousand dollars can become Turkish citizens.

● The owner of the property must pay an annual property tax and pay for utilities.

● Property owners must comply with local laws and the laws of their country.

● Besides the most important responsibilities, there are local features of rental housing and many nuances that should be clear before making a purchase. Our Anga Real Estate team will help you with this.

Find a property in Turkey

Preparation: study of the local market. It is worth getting acquainted with popular areas and pricing policies. Then the selection of a specific option – new or secondary, residential or commercial real estate, land plots.

Prepare your wish list:

- What is your goal?

- What features should your property have?

- What is the desired budget?

- Area;

- Number of rooms; year of construction; condition, etc.

Buying property abroad is a responsible step and requires responsible actions. It is difficult to choose a property based only on the image and description. You need to feel the rhythm and spirit of the place, and for this you should come in person.

Contact us for questions and reservation of tickets, accommodation and sign up for the guided tour.

Sequence of actions when buying property in Turkey

The purchase and sale procedure comprises the following stages:

● Property viewing tour

● Choice of real estate

● Conclusion of a purchase and sale agreement;

● Preparation of documents;

● Payment;

● Transfer of ownership and receipt of TAPU;

Let’s look at each item in more detail.

Step 1: Property viewing tour

Detailed information about the tour is available here.

Fethiye in Winter: 10 Amazing Things To Enjoy!

12 Reasons To Invest In Fethiye!

Step 2: Conclusion of the purchase (sale) agreement and DEPOSIT

You have chosen a certain property. At this stage, we organize a meeting between the seller and the buyer. Make sure you buy:

● Exactly the object we showed you

● From the actual seller

● With no debts

● On agreed terms

The next step is to enter a contract, which is drawn up in Turkish, Russian or English, and make a Deposit (usually up to 10%, depending on the individual terms of each transaction), after which the object is reserved and withdrawn from sale.

The contract of sale must contain the following items: Information about the Buyer and Seller, information about the property (features of construction, address, registration number of the land plot, etc.), a payment schedule is prescribed (discussed with each Buyer individually), a guarantee for the construction and its terms (usually the primary housing is guaranteed for construction from 5 to 10 years), the obligations of the Buyer and Seller, legal and legislative procedures, etc.

If the object is sold with furniture, a list of all items are made and signed as an Appendix to the contract. If the object is purchased from the project (off plan), the terms of commissioning are discussed and written in the contract, floor plans are signed, etc.

Step 3: Preparation of documents

Next, let’s look at preparing important documents for registering a transaction:

1. Execution of a power of attorney if you physically cannot be present at the conclusion of the transaction.

Usually the Buyer executes a power of attorney to the employees of the company, which gives the right to act on his behalf in the process of registration and receipt of all required documents to official bodies and authorities to get permission to purchase real estate in Turkey to the Department of defense or allowed military authorities, the General Department of land cadastre and registry of the relevant authorities, to pay the pre-registration of real estate (Kat İrtifakı) to final registration of the property in housing (Kat Mülkiyeti), it gives the right to get a certificate of ownership (Tapu) if the Buyer can not come himself, arrange for electricity and water, install meters, etc. They issue the power of attorney in a notary office in the presence of a sworn translator.

For registration, you will only need your passport, which is translated into Turkish, and your personal presence. The registration procedure will take only one hour. Note that the power of attorney is issued at the request of the Buyer, and not only in Turkey. Sometimes, for example, if the Buyer has concluded a remote contract and it is not possible to come to Turkey, but you want to get a Tapu in the shortest time, in this case, the power of attorney can be issued in your country in any notarial office, translated into Turkish, certified with an apostille and the original sent to us by mail. In this case, you can pick up the original Tapu immediately after your arrival in Fethiye, or we send the document to you by mail.

2. Get a foreign tax number (Tax ID number).

The procedure for obtaining an individual taxpayer number is simple and takes only 30 minutes. It does not require your presence. To get it, we will need a copy of your passport, your registration address, your father’s and mother’s name, and your mother’s maiden name. The presence of a Tax ID number is a prerequisite for registering a real estate object, opening a Bank account, concluding a contract for providing telephone services, and re-registering water and electricity meters.

3. Opening a bank account

All payments go through a Bank account and the most convenient way is to open an account in a Turkish Bank. You must have:

- Tax ID (foreign tax number)

- international passport with a photocopy

- internal passport with registration

To open a Bank account, you will need to provide a foreign passport and TIN. Some banks ask you to confirm your residence address in your country. As a confirmation, you only need to provide your internal passport or any other document showing your first and last name and exact address, such as an invoice for electricity, water or Internet.

Having a Bank account will help you control the payment for water and electricity, make many payments, and may also be required to provide a statement of the availability of funds in the account, which you can make a wish after receiving TAPU. You can use the Internet banking service, which will help you remotely track and control the movement of accounts. Your presence to open an account to sign a contract and receive a code for using the Internet Bank is mandatory. The registration process takes only one hour.

Real estate valuation report in Turkey.

To make sure of the actual value of the property, the assessment report is mandatory and usually takes 3 days.

Step 4: Payment

The most frequent payment method is via a Bank. You can transfer funds from your country bank. To do this, the Bank can request a purchase and sale agreement.

To get TAPU and transfer ownership, the property must be paid in full. If the purchase involves borrowed funds or installments, then the certificate of ownership specifies the encumbrance which is removed only after full payment.

Step 5: Transfer of ownership and receipt of TAPU

The procedure for transferring ownership of real estate to a new owner and issuing TAPU from the Seller to the Buyer is carried out in the local Cadastral office, in the office of the State Registration Chamber in the presence of an officially accredited translator and takes only one hour.

The purchase and sale transaction is registered in the register, where the Buyer is assigned a registration number for the purpose of identifying the purchased property, and after receiving the TAPU, you become the absolute owner of the property you purchased. At this stage of the transaction, the cost of the object under the contract must be paid, and the required obligations are fulfilled.

Before receiving the Tapu, the Buyer pays a onetime tax on the purchase of real estate, equal to 4% of the value specified in the TAPU (2% from Buyer and 2% from Seller), and state fees (100-200euro).

If you have left a power of attorney in our name, it does not require your presence, we can get the payment for You.

When do I get my TAPU?

Up to 5 days from the moment the seller applies to the Cadastral Office.

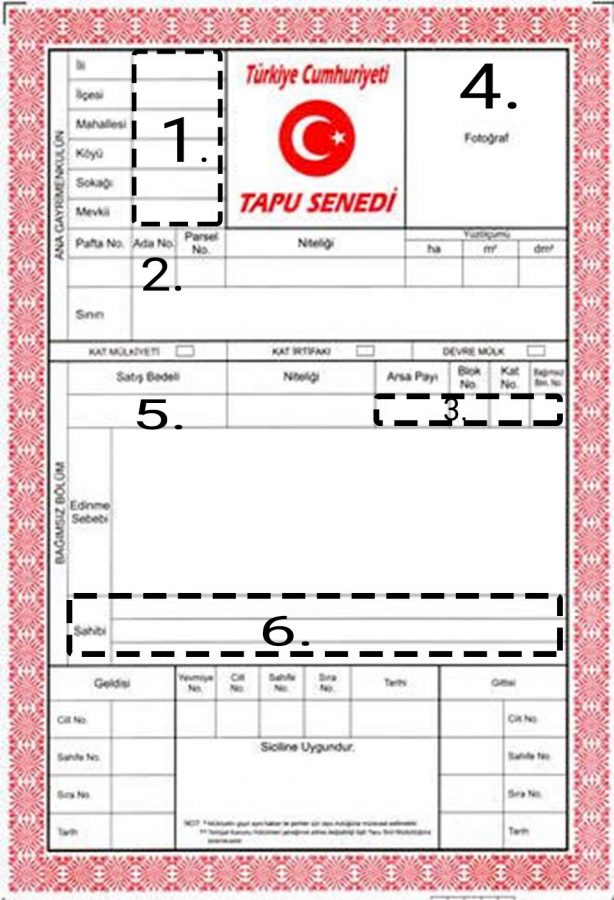

Under Turkish law, TAPU is a certificate of ownership of real estate and the only official document confirming the transfer of ownership rights and sole ownership of real estate by the Buyer. It can be issued to a legal entity, one or more individuals.

The content of the TAPU:

1-complete information about the property (address of the property-district or street name–number of the property).

2-number of the land plot where the object is located

3-the area of the apartment and detailed information about it (apartment number-house number-floor – the area of the object).

4-personal photo of the property owner.

5-the cost

6-full information about the property owner.

Buying house remotely in Turkey

If you physically cannot fly to Turkey, but you want to buy residential or commercial real estate, you can do this remotely. To do this, you need to issue a power of attorney in a notary office, specifying all the powers and restrictions of the person who gets the right to execute a purchase and sale transaction on behalf of a foreign citizen.

Cost of buying a property in turkey (onetime)

Electricity, water and telephone

When building a new building, you need to issue an Iskan (act of putting the house into operation) – a document authorizing the connection of communications, which specifies the technical parameters of 185-245 euros. When buying a secondary apartment, you don’t need Iskan.

The cost of an Interpreter

When receiving and signing a TAPU with the participation of foreign persons, it is mandatory to have an accredited translator, whose services range from 100 to 200 Turkish liras (12-25 euros).

Agency fee

The agency commission of a realtor according to Turkish law is 2%+VAT from the Buyer and 2%+VAT from the Seller.

Certificate of Ownership

About €300 to pay the fee for issuing TAPU and state interpreter services.

*All prices in euros may vary depending on the exchange rate.

Buying an apartment in Turkey – annual expenses

Besides onetime expenses when buying real estate, there are also annual expenses.

Aidat-payment for maintenance of a residential complex from 50 to 700 TRY depending on the infrastructure;

Annual Property Tax 2022

Annual property tax in Turkey every year must pay property tax-0.2% to 0.6%, depending on the object.

For residential real estate-0.1% to 0.3%

For commercial – 0.2%

For land plots with a construction permit (arsa) – 0.3% to 0.6%

For land plots (arazi) – 0.1%

Compulsory Earthquake Insurance (DASK)

DASK (Dogal Afet Sigortalari Kurumu) – insurance against natural disasters. Insurance is issued once a year and is mandatory for all owners, including foreigners who have purchased housing or commercial properties in the country.

There are different rates according to the building and an area. For more information read here.

There are all key factors you should know before buying property in Turkey. You are always welcome to contact us or visit our office.

Turkey residence permit by investment

You can get short term Turkish residency permit by investing in property.

As of May 5, 2022, foreign nationals wishing to benefit from the Turkish citizenship by investment scheme will have to purchase property worth at least:

$75,000 and over if it is located in one of the 30 metropolitan cities in Turkey

$50,000 and over if it is located in one of the remaining 51 smaller cities in Turkey.

The requirement will apply to all districts in these cities, meaning that foreign nationals will have to buy a house from Bodrum or Fethiye, for example, that is at least $75,000 because it is under the jurisdiction of Muğla Metropolitan Municipality.